The Trick to Stick to Your Budget

You have a dream for something that you wish you could afford: a new car, a house, jewelry, a trip of a lifetime. You do some planning and realize that if you control your spending, you’ll be able to save enough money to realize your dream. However, sticking to a budget can be tough. Categorizing your spending can be a chore and cheating a little on your budget can feel temptingly harmless. So how do you actually stick to a budget?

One of the simplest ways to budget is separating your money into three accounts:

1) Monthly spending for basic needs

2) Monthly spending on luxuries

3) Savings towards your dream

And when we say separate your money, you can actually separate your savings into three different bank accounts. For example, let’s say your take-home monthly paycheck is $3,000. You could automatically transfer $1,400 into your “basic needs” account to cover housing, groceries, etc., transfer $600 into your “luxury” spending account for restaurants, entertainment, and electronics -- and put the remaining $1,000 into your “dream” account, which will grow every month. When you spend, always use a card or cash that corresponds to the appropriate account.

Segmenting your income increases your control over your money

If you’ve “segmented” and blow through your luxury spending budget, you’ll be left with $0 in the account until the next automatic monthly transfer. This setup means you can’t “accidentally” overspend from the account. If you’re thinking that you might raid your savings account when your luxury spending account is empty, you’re not alone. The good news is you can help yourself resist this temptation by renaming your savings account to the name of your goal.

Naming your accounts reminds you of your priorities to help you reach your goals

For most people, it’s easier to “Confirm $200 transfer from Savings Account 2345X” than to “Confirm $200 transfer from My Dream Car”. Making your accounts personal will be a motivation to stick to your budget if you’re ever feeling tempted. It will remind you of why you set a budget in the first place. Some studies also suggest that just writing down your goal will make you more likely to achieve it.

Teaching budgeting to children with jars of money

One common approach to teach children about money is to use a system of labelled jars, with names such as spending, saving, and giving. The jars approach capitalizes on the benefits of account segmentation and naming, and has the added benefit of some visibility into how much is actually inside, unlike a ceramic piggy bank. Using the jars system helps children overcome spending money as soon as they get it and shows them how much their savings can accumulate over time.

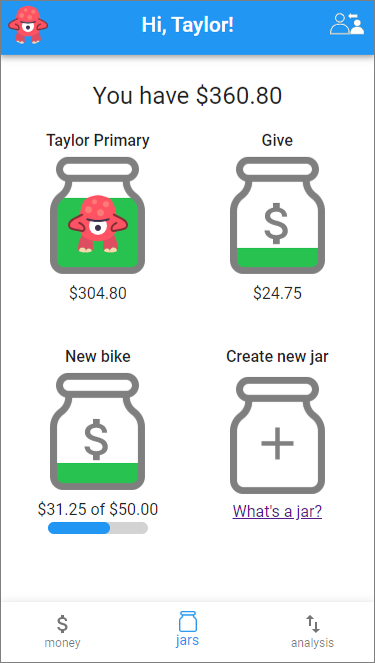

Guardian Savings offers a digital jar with some added benefits

Guardian Savings has digitized the jar concept and improved kids’ learning experience. This digital experience allows children to immediately see precise values in each jar and relative size comparisons, without having to spend twenty minutes counting bills and coins. Furthermore, your children can name the jars whatever they want. They can optionally set goal amounts. Goals come with automated analytics and insights into progress, which they wouldn’t have with a physical cash system, and can serve as extra motivation.

If you are already a Guardian Savings user, explore the new jars system with your child! Consider creating spend, save, and give jars or whatever system and labels make sense to you. If there is something your child has their eyes on, help them set up a jar with a goal -- and give that jar a name! Your kids will learn life-long lessons from working towards a financial goal and the satisfaction when they eventually reach it!