What You Never Want Your Children to Inherit: Financial Illiteracy

You hope your kids inherit your spouse's good looks, your sense of humor, and any number of other traits. But what about the things you hope your kids never get, your varicose veins, and perhaps, the way money seems to fly out of your wallet?

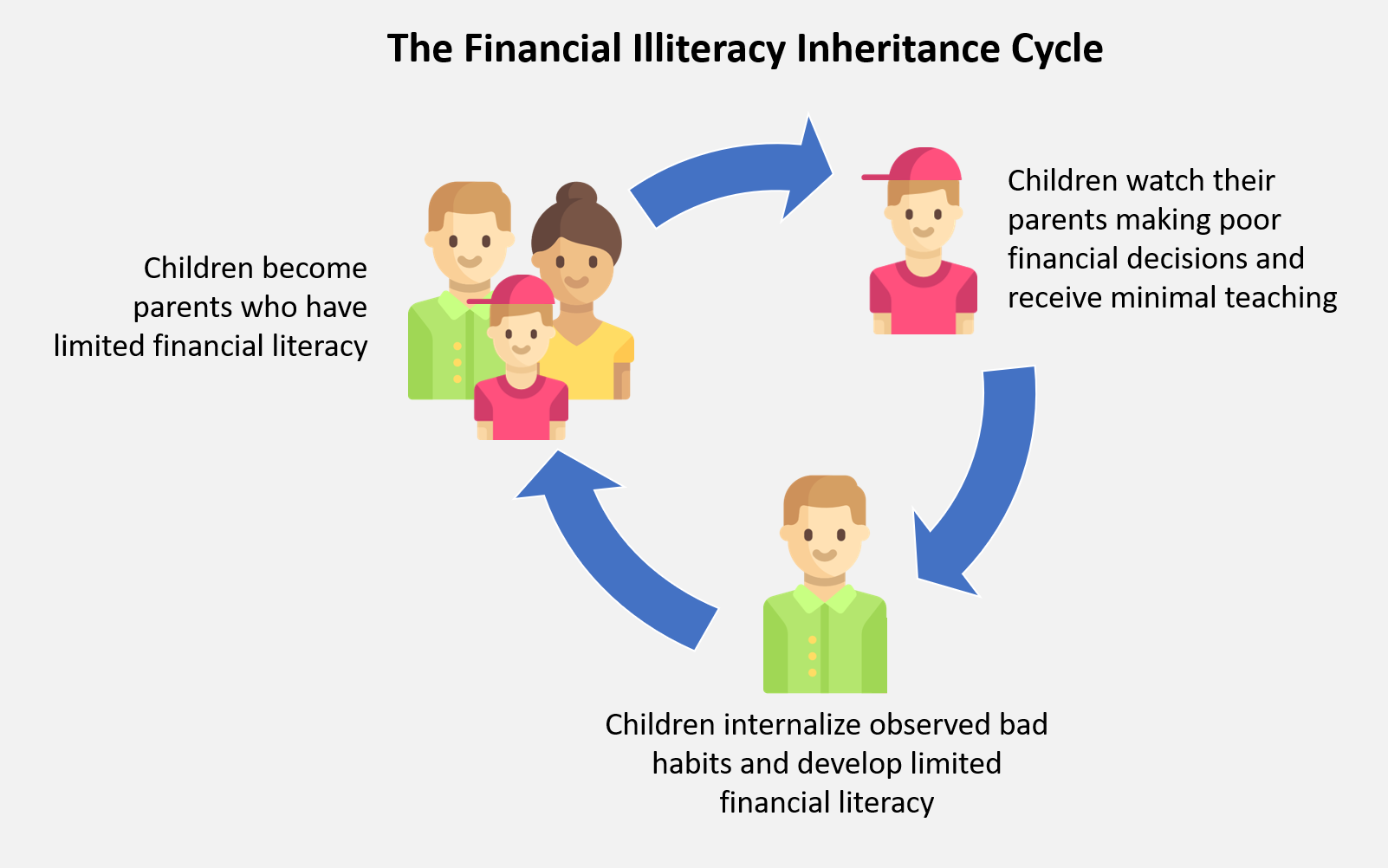

I’m sure you have heard the saying ‘kids are always watching’ - well that expression goes for spending habits too. Financial literacy is something that is often passed on from one generation to the next. However, for many families that means passing on incomplete knowledge or bad habits. This dynamic creates a vicious cycle of inherited financial illiteracy, magnifying poverty and unhappiness.

How many people does the financial illiteracy cycle effect?

Sadly, half of Americans, or 120 million adults, do not seem to practice responsible finances. This is a massive problem considering that half of Americans‘ kids will likely grow up financially illiterate.

Why is financial illiteracy highly heritable?

The burden of teaching personal finance falls on parents. Many schools don’t teach financial literacy and if they do, it is limited to theory. Financial institutions are not focused on teaching children financial literacy either. With minimal school and institutional support, parents bear the brunt of this educational burden often without guidance on best practices or community resources.

Children absorb their parents habits and attitudes toward money through what they are told and what they see their parents do. Saving is less visible to children and often only taught through simple mantras like “saving is good” and “spend less than you earn” because that is how the parents were taught. What a child sees is often only a portion of their parents’ complete financial experience (taxes, saving for retirement etc) and this fall short of a holistic education.

In some cases, parents will actively teach and pass on irresponsible behavior! Some parents will coach their kids “you’re not living if you are not in debt” or encourage luxury spending “because you deserve it” rather than taking care of financial basics such as establishing an emergency savings fund. You don’t have to look far to find stories of trust fund kids squandering fortunes rather than prioritizing financial security.

Even when parents strive to teach their children positive lessons, their hard work can be undone by every day bad financial habits. When parents break their own rules that they’ve taught their children, like “save more than you earn”, it makes children think that it is okay and normal to deviate from the rules. Children often imitate what they see their parents doing and grow up thinking it’s okay to use a payday loan to cover a non-essential expense, prioritize wants over needs, or treat themselves to luxuries when they really should make a no-frills retirement contribution.

How can the cycle be broken?

Change is needed to break the financial illiteracy cycle. Here are some trends with promising results:

Better parental role models: It’s never been easier to build and track a budget with automated online tools. There are a number of robo-advisors and financial planning tools that are helping parents improve their personal finance decisions. With parents becoming more financially literate, children will have better role models to shape their own behavior.

Financial literacy education in schools: Several nonprofits provide free financial literacy curriculum to schools and advocate for its introduction to school systems. Though financial literacy education in schools is rare and generally limited to theory, it is still valuable, especially if coupled with practical experience and coaching

FinTech that enables youth experience: There are products that enable children to learn about money through practice in a safe and controlled environment, such as Guardian Savings. Through practice and rewards, kids can learn more about money at an earlier age and more effectively.

With stronger role models and better youth education resources, we can break the illiteracy inheritance cycle and raise a generation that makes better decisions about money!